Bennett Jones has many years of experience helping people write off debt and build stronger finances. We will help you pay off your loans, credit cards, catalogues, payday loans and many other debts.

Stop creditors harassing you over non-payments of personal, business, or tax debts. We’ve written off the debt of thousands of our customers, you can read about their stories and 5* reviews on Trustpilot.

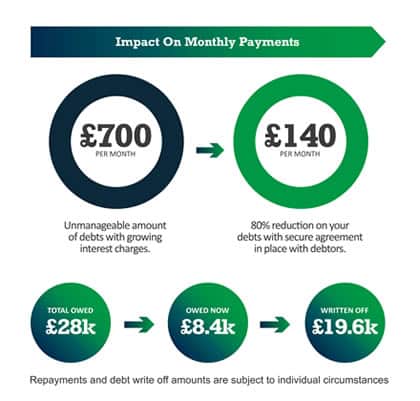

Check if you qualify for debt help by completing the form above. We can do a brief assessment and then tell you what is required to move forward. You don’t need to worry about your creditors contacting you in the future. Our UK based team is ready to help you every step of the way. You could write off up to 80% of your debt.

If an IVA is not right for you we will give you free no-obligation help so you can decide on the best solution for you. You could write off up to 80% of your debts (10% of our customers wrote off 80% in the last 12 months, with a typical figure ranging from 25%-75%).

Bennett Jones - the debt management & IVA specialists

Breathe easier with our debt help today

Our team at Bennett Jones has many years of experience in dealing with creditors and helping clients get out of debt. We are here to provide support and guidance for you at a time when you need it most. If you would like to learn more about the solutions available, our experts will provide you with confidential debt help free of charge. There are lots of ways to contact our team:

- Complete the form above

- Call us during office hours on 0161 960 0054

Bennett Jones has helped thousands of people solve their debt problems. We can stop creditor pressure and write off debts you can’t afford. No more harassing text messages, emails, letters, phone calls, or home visits from your creditors. The team at Bennett Jones will lead you to financial recovery, breaking you free from the stigma of debt.

Our simple 3 step process:-

Step 1

Complete our online form (completely private & confidential). We will let you know what options you qualify for in under a minute. You can pick up the phone and call us at any time.

Step 2

Chat to one of our debt experts. We can offer solutions to your debt problems. We know how difficult it is to have unmanageable debts, but our trained debt specialists are here to help without judgement.

Step 3

We can take action with our no-obligation service. Leave the rest to us and get back to enjoying life without money worries. Our debt action plan will feel like a burden has been lifted and your life can return to normal.

Check if you qualify by completing the form above.

Debt Management Plans

This is an informal arrangement between you and your creditors which allows you to repay your debts, at a rate that you can afford without relying on further borrowing. If during your DMP you are able to offer creditors a lump sum to settle your debts, it is possible to agree to discounted settlements.

A DMP is suitable if you are struggling to meet their minimum debt payments but have some surplus money available each month once you have paid all your household bills. Household bills includes “priority payments” which includes rent, mortgage and utilities plus something toward any arrears. Our advisors will assess your situation and determine if a debt management plan is suitable for you.

There are other solutions including IVA’s, Debt Relief Orders, Bankruptcy and Dealing Directly with your Creditors which may be appropriate. If you live in Scotland, the solutions are different, please visit Scottish Debt Solutions. For full debt advice and whether a DMP would be your best option, you can also speak to one of our advisors.

Read more below about the solutions to problem debt

Bennett Jones is here to help you explore all the options for you to regain control of your finances and become debt-free. Our team members have the knowledge, experience and professional qualifications to ensure you receive the guidance and support you need to navigate your journey to financial recovery. We comply with all statutory, regulatory and best practice obligations. Don't just take our word for it, read some of our excellent customer reviews and case studies to see how our customers have appreciated how our help.

What is a Debt Management Plan?

A Debt Management Plan (DMP) is an informal arrangement between you and your creditors that allows you to repay your debts, normally in full, at a rate that you can afford without relying on further borrowing. If during your DMP you are able to offer creditors a lump sum to settle your debts, it is possible to agree on discounted settlements.

Is a Debt Management Plan suitable for me?

A Debt Management Plan is suitable if you are struggling to meet their minimum debt payments but have some surplus money available each month once you have paid all your household bills. Household bills includes “priority payments” which includes rent, mortgage and utilities plus something toward any arrears. Our advisors will assess your situation and determine if a debt management plan is suitable for you.

There are other solutions including IVA’s, Debt Relief Orders, Bankruptcy and Dealing Directly with your Creditors which may be appropriate. If you live in Scotland, the solutions are different, please visit Scottish Debt Solutions.

For full debt advice and whether a Debt Management Plan would be your best option, you can also speak to one of our in-house advisors.

Debt Management Plans – Advantages and Disadvantages

Doing the right thing is only possible if a clear picture is available of the advantages and disadvantages of a Debt Management Plan. A debt management plan quickly gets your debts under control and relieves the stress of debt but there needs to be a long term plan to clear your debt.

Advantages

A Debt Management Plan is designed to allow you to pay what you can realistically afford to your creditors each month. Generally, creditors will agree to accept reduced payments and freeze or reduce interest charges.

- The major benefit that we find our clients appreciate is having us liaise and deal with all creditors and their correspondence. This includes dealing with phone calls, letters and takes away the stress of creditor interaction.

- Creditors may freeze interest and charges

- If you’re struggling to meet your normal payments to creditors, a DMP allows you to pay an affordable monthly contribution

- A DMP is flexible. You can terminate your plan at any time.

- A DMP is an informal solution and should ideally provide for you to clear your debt in less than 10 years. If the plan looks like it could take more than 10 years, a DMP may not be appropriate unless you feel your circumstances are likely to change which will enable you to clear your debt in a 10 year period.

- Creditors may stop further action. Our team are attentive and will work hard to ensure creditors do accept your plan.

Disadvantages

- A DMP is an informal debt solution and creditors are not obliged to freeze interest and charges. Some creditors may agree to reduce interest charges rather than freeze them. Continued charges could result in it taking longer and costing you more to repay your debts.

- As a DMP is an informal arrangement, there are certain debts such as arrears of council tax that cannot be included due to the risk of action against your assets. There are other solutions such as an IVA which can include arrears of priority bills.

- A DMP could have a negative impact on your credit file. Creditors can issue default notices which will remain on your credit file for 6 years. Your ability to obtain credit will be affected.

- You may from time to time receive an unwanted call from a creditor especially if they are using a debt recovery company. Politely tell them you are in a DMP and state our company name and your personal advisor. We will take care of the rest.

- We cannot guarantee that creditors will not take legal action or that they will stop collection activity. Such action could result in a judgment and could potentially lead to a charging order if you have a property.

- If you cancel your DMP, creditors could end payment arrangements previously agreed and charges could be reapplied to your debts.