Bennett Jones has many years of experience helping people write off debt and build stronger finances. We will help you pay off your loans, credit cards, catalogues, payday loans and many other debts.

Stop creditors harassing you over non-payments of personal, business, or tax debts. We’ve written off the debt of thousands of our customers, you can read about their stories and 5* reviews on Trustpilot.

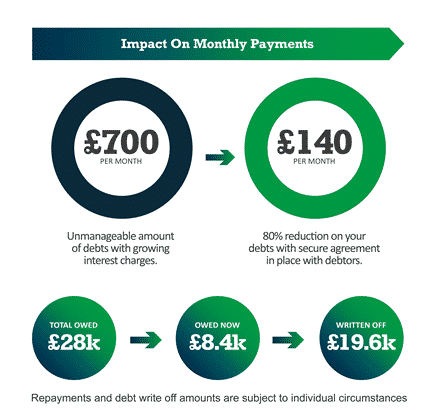

Check if you qualify for debt help by completing the form above. We can do a brief assessment and then tell you what is required to move forward. Our UK based team is ready to help you every step of the way. You could write off up to 80% of your debt.

Bennett Jones - the debt help & IVA specialists

Breathe easier with our debt help today

Our team at Bennett Jones has many years of experience in dealing with creditors and helping clients get out of debt. We are here to provide support and guidance for you at a time when you need it most. If you would like to learn more about the solutions available, our experts will provide you with confidential debt help free of charge. There are lots of ways to contact our team:

- Complete the form above

- Call us during office hours on 0161 960 0054

- Livechat is available during office hours

Bennett Jones has helped thousands of people solve their debt problems. We offer debt help that is tailored to your personal circumstances.

We can stop creditor pressure and write off debts you can’t afford. No more text messages, emails, letters, phone calls, or home visits from your creditors. The team at Bennett Jones will lead you to financial recovery, breaking you free from the stigma of debt.

Our simple 3 step process:-

Step 1

Complete our simple online form (completely private & confidential). We will let you know what options you qualify for in under a minute. You can pick up the phone and call us at any time.

Step 2

Chat to one of our debt experts. We can offer solutions to your debt problems. We know how difficult it is to have unmanageable debts, but our trained debt specialists are here to help, quickly and without judgement.

Step 3

We can take immediate action today with our no-obligation service. Leave the rest to us and get back to enjoying life without money worries. Our debt action plan will feel like a burden has been lifted and your life can return to normal.

Check if you qualify by completing the form above.

April 2024, Adam

I would like to thank Bennett Jones for helping me with my IVA proposal. I'm a glass half full person but the realities of life and unforseen circumstances with finances had taken its toll. Bennett Jones has helped me to have a fresh start and take control back of my finances. It's a huge load lifted off my shoulders. Many thanks to the team for there support and professionalism.

March 2024, Sheezana

I can’t thank Laura enough for doing all the hard work for helping me sort out my finances. Great customer service, friendly, kept me in contact with everything that was going on. And made it happen. Great company too go to you won’t be disappointed. Thank you Bennett Jones and mostly thank you so much Laura for all your hard work. Making it happen

Read more below about the solutions to problem debt

Bennett Jones is here to help you explore all the options for you to regain control of your finances and become debt-free. Our team members have the knowledge, experience and professional qualifications to ensure you receive the guidance and support you need to navigate your journey to financial recovery. We comply with all statutory, regulatory and best practice obligations. Don't just take our word for it, read some of our excellent customer reviews and case studies to see how our customers have appreciated how our help.

An IVA may not be suitable for everyone who needs help with their debts. Fees may apply, but the initial assessment is free. Writing off debt with an IVA will affect your credit rating (see our FAQ). If an IVA is not right for you we will give you free no-obligation help so you can decide on the best solution for you. You could write off up to 80% of your debts (10% of our customers wrote off 80% in the last 12 months, with a typical figure ranging from 25%-75%).

An IVA is a fixed-term debt plan that legally protects you from creditors. If you are a homeowner, once your IVA is approved your home is protected. If you have a private pension, this will also be protected. An IVA will typically last for 5 years with you making one affordable monthly payment. You don’t need to worry anymore about your creditors contacting you. Once the final IVA payment is made, you are no longer be liable for any of the debts included in your IVA and there will be no further balance to pay, even if your debts have not been repaid in full. Our UK based team is ready to help you every step of the way.

An IVA is established and overseen by a Licensed Insolvency Practitioner, who acts as the mediator between you and your creditors. The exact amount of your monthly payment will depend on your circumstances but can start from as low as £70. If you are a homeowner, once your IVA is approved your home is protected. If you have a private pension this will also be protected.

It is realistic to expect to write off between 25% and 75% of your debts in an IVA. The debt write off amount will depend on your circumstances and is subject to your creditors approving your proposal. Your monthly IVA payments may be different to the example as they will be based on your personal circumstances. All fees and costs of your IVA which will be paid from your monthly IVA payments will be clearly explained to you.

Typically an IVA will last for 5 years with you making an affordable monthly payment from your income into your IVA. Once your IVA has been approved, you don’t need to worry any more about your creditors contacting you.

Your insolvency practitioner who supervises your IVA will deal with all your creditors. Once the final IVA payment is made, you are no longer liable for any of the debts included in your IVA and there will be no further balance to pay, even if this means your debts have not been repaid in full.

To be eligible for an IVA, you need to show that you do not have enough money to pay your debts in a reasonable amount of time. In most cases, your debts must be more than your assets, including any property you own. You also need to have some surplus income each month after paying for your living costs. When you talk to Bennett Jones about an IVA or other debt solutions, we make sure that you are aware of all the possible solutions for your situation. You will be able to make the best choice for your circumstances. If you decide an IVA is right for you, we will support you on your journey to financial health.

We understand how difficult it is to cope with unmanageable debts and the stress and worry this causes. Bennett Jones is here to help you explore all the options for you to regain control of your finances and become debt-free.

To qualify for an IVA, you need to be a resident of England, Wales or Northern Ireland. You will also need to have a minimum debt level of £6,000. You must owe money to at least 2 companies. You will need to have some surplus income after paying your living expenses so that you can afford to make payments into your IVA.

All IVAs must be arranged through a licenced insolvency practitioner and that is where Bennett Jones steps in. If you qualify for an IVA, you could be on your way to writing off your seemingly unaffordable debts, setting you up for a debt-free future.

IVA is short for Individual Voluntary Arrangement and DMP is short for Debt Management Plan. IVAs allow you to write off a large proportion of your debt and they are legally binding on your creditors. A DMP is not legally binding – it is simply an informal agreement between you and some or all of your creditors. This means that if you are in a DMP your creditors can still take legal action against you and continue to contact you directly.

In England and Wales, an Individual Voluntary Arrangement (IVA) is a formal alternative for individuals wishing to avoid bankruptcy. In Scotland, the equivalent debt solution is known as a Protected Trust Deed.

Once an IVA is agreed upon, creditors are forbidden from contacting you directly to attempt to obtain funds. Whilst they usually receive a larger payment than they would with bankruptcy, you benefit from frozen interest/fees and manageable payment structures. What is more, with an IVA, you only pay what you can afford, even if this means you do not pay your debts in full.