IVA Timeline

As you are making an important financial decision it is important to make sure that you take the time you need to read and understand your IVA proposal and make sure this is the right decision for you.

Here at Bennett Jones, we take time to explain your options to you and we are happy to answer any questions or concerns you may have before you make the decision to proceed with your IVA. Once you have read and approved the IVA proposal you are going to make to your creditors it is necessary to send the proposal to your creditors and allow your creditors at least 14 days to consider and vote on your proposal

IVA steps and timing

Typically the time taken to set up an IVA is between 21 and 28 days

- Step 1: Contact the IVA team at Bennett Jones.

- Step 2: We perform a credit check and assess all your debts. This credit check will not affect your credit score.

- Step 3: Gathering your financial information. We gather detailed information regarding your regular expenses (rent, travel, food, utility bills, etc.) and make an assessment of how much you can reasonably afford to pay back each month after paying these expenses.

- Step 4: Building your IVA proposal. Our Insolvency Practitioner will create your draft IVA proposal to present to your creditors. It will include a detailed financial breakdown of your current circumstances and proposed repayment terms. Your proposal will explain why your creditors should accept your IVA.

- Step 5: Your creditors consider your IVA proposal. Our Insolvency Practitioner finalises the proposal with your agreement and calls a “virtual” creditors’ meeting. Each of your creditors can vote on your proposal. To have an IVA agreed, you will need 75% in value of your creditors who vote at the meeting putting in votes to approve your proposal.

- Step 6: IVA Approval. You’ll formally enter into your IVA and immediately become protected against all debt recovery action.

- Step 7: Annual Review of Your IVA. Your Insolvency Practitioner will conduct a review each year to ensure you’re still able to make your payments. If your income has increased you may be requested to increase your IVA payments. If you are struggling to manage your payments we will be here to help you.

- Step 8: Debt free. As long as you keep to the terms of your IVA proposal, your remaining debt will be written off at the end of your IVA. You will then be debt-free.

Breathe easier with an IVA with Bennett Jones today

If creditors agree to the IVA then it will usually take five years of monthly payments until the arrangement ends. An IVA is not suitable for everyone and all other debt solutions should be considered before opting to begin the IVA process. If this is the right debt solution the IVA application can be the first step toward a debt-free life. Our team at Bennett Jones has many years of experience in dealing with creditors and administering IVAs. We are here to provide support and guidance for you at a time when you need it most. If you believe an IVA may be the best solution or you would like to learn more about what the process entails, our experts can provide you with confidential advice. There are lots of ways to contact our IVA team:

- Complete the form above

- Call us on 0161 960 0054

Bennett Jones has helped thousands of people solve their debt problems. We understand how stressful and difficult life is when you can’t pay your debts and your bills.

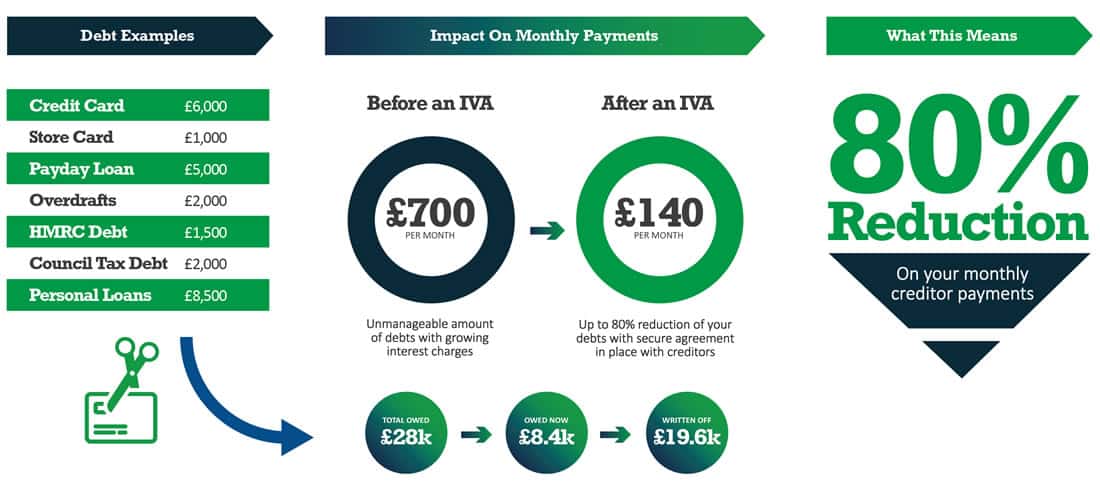

You can trust Bennett Jones to help you if you are struggling to pay your debts. We specialise in Individual Voluntary Arrangements – a legal solution that allows for unaffordable debts to be written off. With an IVA from our team, you will make affordable repayments to your creditors over a fixed period, with the remaining debt written off at the end.

An IVA may not be suitable for everyone who needs help with their debts. Fees may apply, but the initial assessment is free. Writing off debt with an IVA will affect your credit rating (see our FAQ). If an IVA is not right for you we will give you free no-obligation help so you can decide on the best solution for you. You could write off up to 80% of your debts (10% of our customers wrote off 80% in the last 12 months, with a typical figure ranging from 25%-75%).

June 2024, Lynne

Patient and understanding debt management advice. From the beginning to the end of my five year journey to take control of my debt everyone at Bennett Jones have been nothing but kind and supportive. Always supporting me without making me feel uncomfortable about my circumstances and explaining everything very patiently, showing understanding of how difficult this can be for someone to undertake and guiding me gently through concerns and daft questions. Thank you for your assistance in taking back control and making a fresh start after a particularly challenging time in my life.

May 2024, Adam

I would like to thank Bennett Jones for helping me with my IVA proposal. I'm a glass half full person but the realities of life and unforseen circumstances with finances had taken its toll. Bennett Jones have helped me to have a fresh start and take control back of my finances. It's a huge load lifted off my shoulders.......

April 2024, Beverley

I would like to thank Bennett Jones for all their help over the past 5 years.. I was in a pretty dark place financially. And through the debt advice helpline I found Bennett Jones.. From start to finish they have been professional sympathetic and always helpful. I've recommended friends who are also happy with their service. If I could give more than 5 stars I would.

The debt write off amount for each customer differs depending upon their individual financial circumstances and is subject to the approval of their creditors. The example provided of 80% has been achieved by 10% of our customers in the last 12 months