Bennett Jones is here to help you regain control of your finances. We’ve helped thousands of customers become debt-free by using an IVA. Complete the form above to get no-obligation debt help from our associated company The Debt Advisor Ltd.

Our relationship with The Debt Advisor

The Debt Advisor and Bennett Jones have common shareholders. The Debt Advisor Ltd is authorised by the Financial Conduct Authority to provide debt advice. There is no charge for initial advice provided by The Debt Advisor. Depending upon the solution that you choose, fees may apply.

If you are living in rented accommodation your IVA will typically last for 5 years. If you are a home owner and there is ‘equity’ in your house i.e. if the house was sold today there is likely to be a surplus remaining for you after the repayment of the mortgage and costs of sale then your creditors will expect you to try and realise some of this equity in addition to paying income contributions. If it is too expensive or not possible for you to obtain a remortgage to realise equity you will expect to pay 12 additional income contributions meaning that you will pay 72 contributions in total. Use the calculator below to see how your IVA contributions will be used to pay something to your creditors after the costs of the IVA have been paid. It is important to remember that although your creditors may only receive a small amount of the debt which you owe to them you will nevertheless be completely debt-free at the end of your IVA.

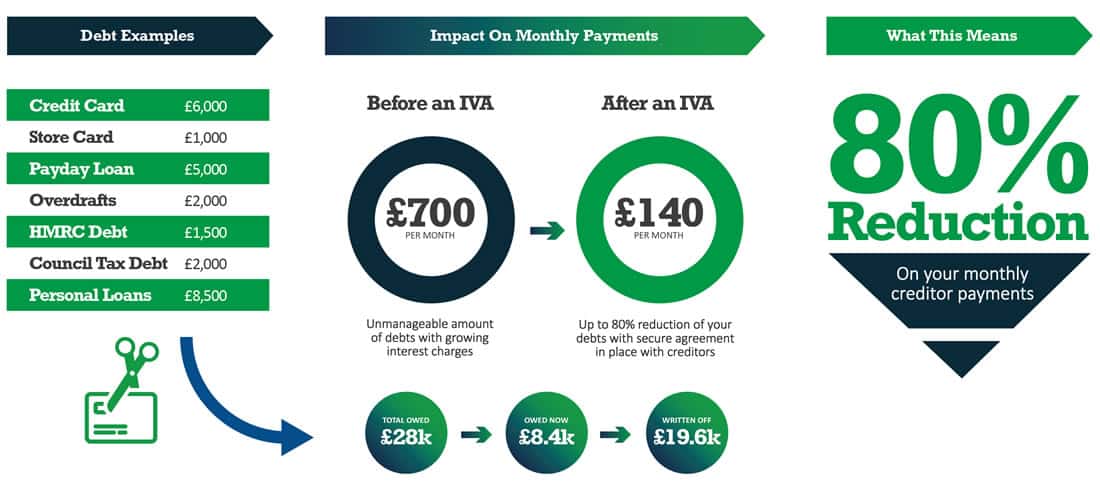

The debt write off amount for each customer differs depending upon their individual financial circumstances and is subject to the approval of their creditors. The example provided of 80% has been achieved by 10% of our customers in the last 12 months