To be eligible for an IVA, you need to show that you do not have enough money to pay your debts off in a reasonable amount of time.

In most cases, your debts must be more than your assets, including any property you own. You also need to have some surplus income each month after paying for all of your basic living costs. When you talk to Bennett Jones about an IVA or other debt solutions, we make sure that you are aware of all the possible solutions for your situation. You will be able to make the best choice for your circumstances. If we think an IVA is right for you, we will support you on your journey to financial health. To qualify for an IVA, you need to be a resident of England, Wales or Northern Ireland. You will also need to have a minimum debt level of £6,000 and you must owe money to at least 2 companies. Additionally, you will need to have some surplus income after paying your living expenses so that you can afford to make payments into your IVA.

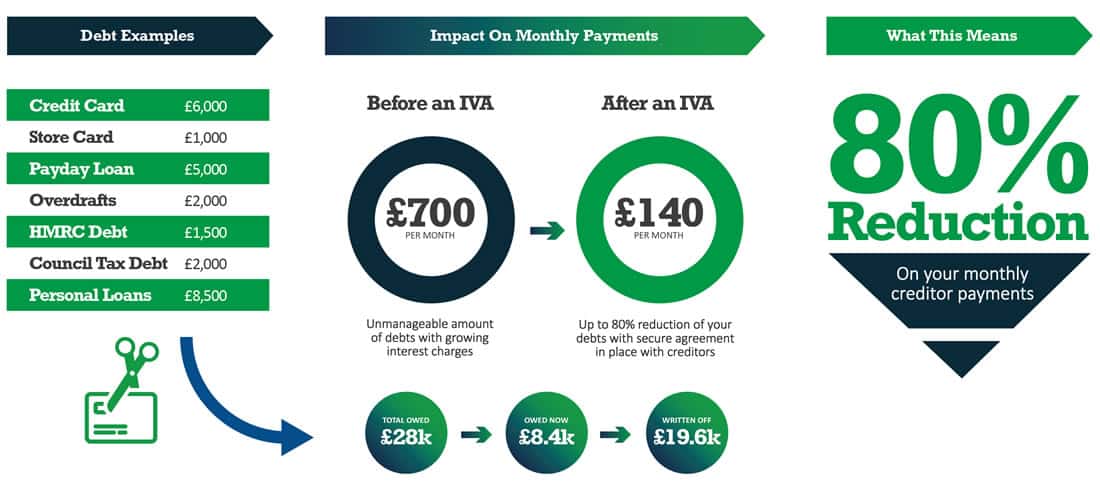

The debt write off amount for each customer differs depending upon their individual financial circumstances and is subject to the approval of their creditors. The example provided of 80% has been achieved by 10% of our customers in the last 12 months