Bennett Jones is here to help you regain control of your finances. We’ve helped thousands of customers become debt-free by using an IVA. Complete the form above to get no-obligation debt help from our associated company The Debt Advisor Ltd.

Our relationship with The Debt Advisor

The Debt Advisor and Bennett Jones have common shareholders. The Debt Advisor Ltd is authorised by the Financial Conduct Authority to provide debt advice. There is no charge for initial advice provided by The Debt Advisor. Depending upon the solution that you choose, fees may apply.

Bennett Jones has many years of experience helping people write off debt with an IVA. We could help you write off your loans, credit cards, catalogues, payday loans and many other debts.

We can help stop creditors from harassing you over non-payments of personal, business, or tax debts. We’ve helped write off the debts of thousands of our customers.

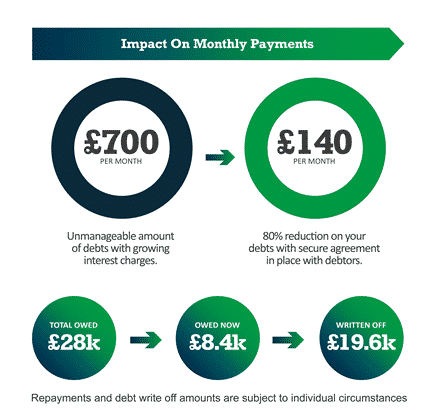

Check if you qualify for an IVA by completing the form above. Our trusted partner, The Debt Advisor Ltd will then contact you to do an assessment. A UK-based team is ready to help you every step of the way. You could write off up to 80% of your debt.

Read more below about the solutions to problem debt

Our team members have the knowledge, experience and professional qualifications to ensure you receive the guidance and support you need to navigate your journey to financial recovery. We comply with all statutory, regulatory and best practice obligations.

An IVA may not be suitable for everyone who needs help with their debts. Fees apply. Writing off debt with an IVA will affect your credit rating (see our FAQ). You could write off up to 80% of your debts (10% of our customers wrote off 80% in the last 12 months, with a typical figure ranging from 25%-75%).

An IVA is a fixed-term debt plan that legally protects you from creditors. If you are a homeowner, once your IVA is approved your home is protected. If you have a private pension, this will also be protected. An IVA will typically last for 5 years with you making one affordable monthly payment. Once the final IVA payment is made, you are no longer be liable for any of the debts included in your IVA and there will be no further balance to pay, even if your debts have not been repaid in full. A UK based team is ready to help you every step of the way.

An IVA is established and overseen by a Licensed Insolvency Practitioner, who acts as the mediator between you and your creditors. The exact amount of your monthly payment will depend on your circumstances but can start from as low as £100. If you are a homeowner, once your IVA is approved your home is protected. If you have a private pension this will also be protected.

It is realistic to expect to write off between 25% and 75% of your debts in an IVA. The debt write off amount will depend on your circumstances and is subject to your creditors approving your proposal. Your monthly IVA payments may be different to the example as they will be based on your personal circumstances. All fees and costs of your IVA are paid through your monthly IVA payments will be clearly explained to you.

Our insolvency practitioner (who supervises your IVA) will deal with all your creditors. Once the final IVA payment is made, you are no longer liable for any of the debts included in your IVA and there will be no further balance to pay, even if this means your debts have not been repaid in full.

To be eligible for an IVA, you need to show that you do not have enough money to pay your debts in a reasonable amount of time. In most cases, your debts must be more than your assets, including any property you own. You also need to have some surplus income each month after paying for your living costs.