We could help you get out of debt, with your loans, credit cards, HMRC, council tax, catalogues, payday loans and many other debts. With our financial assistance, you could write off a large portion of your debt. Stop bailiffs and creditors harassing you over personal, business, or tax debts. Bennett Jones has helped thousands of people solve their debt problems with the smooth implementation of an IVA.

- Say goodbye to grinding debt

- Debt assistance focussing on a fresh start

- See if you qualify for an IVA (free)

- Stop legal actions, bailiffs, harassment and debt letters

- Rescue your house, car and other assets

- No obligation to use our service

- We are regulated by the IPA

- No call centres, agents or middlemen

Immediate IVA help

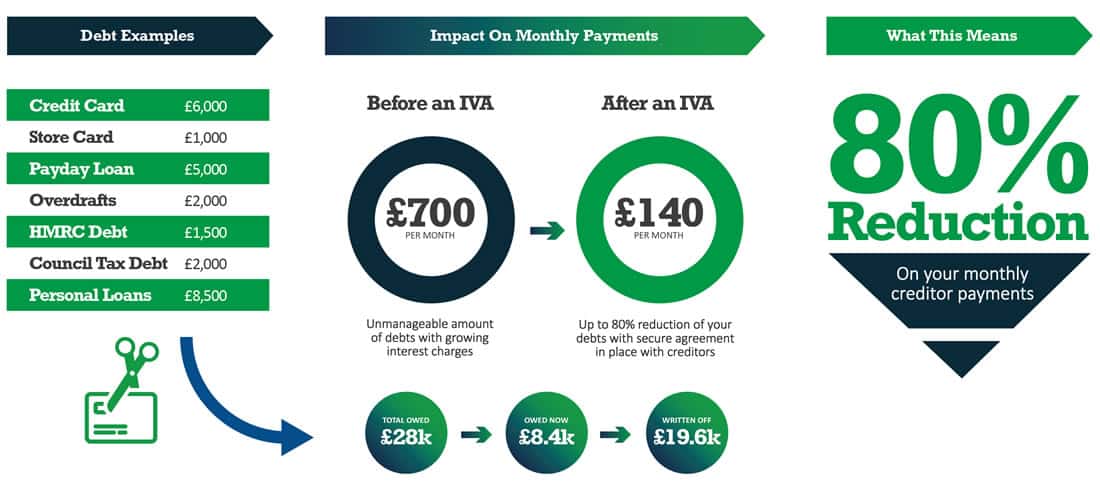

An IVA is a formal agreement between you and your creditors. It is a fixed-term debt plan that legally protects you from your creditors. An IVA freezes interest and cuts your monthly repayments to an affordable level. Better still, any debt left unpaid when the term finishes is written off. The exact amount of your monthly payment will depend on your circumstances but can start from as low as £70. Typically an IVA will last for 5 years with you making an affordable monthly payment from your income into your IVA.

- If you are a homeowner, once your IVA is approved your home is protected.

- If you have a private pension this will be protected.

- Once your IVA has been fully approved, you don’t need to worry any more about your creditors contacting you.

- Once the final IVA payment is made, you are no longer be liable for any of the debts included in your IVA and there will be no further balance to pay, even if this means your debts have not been repaid in full.

Why choose Bennett Jones for an IVA?

We specialise in Individual Voluntary Arrangements (IVA) – a legal solution that allows for unaffordable debts to be written off. We’ve given debt help to thousands of customers, you can see their 5* reviews on Trustpilot.

The sooner you start dealing with your debt, the sooner you’ll have it beaten. If you need some help getting started with a plan, or if you’re not sure about your exact circumstances, then please contact Bennett Jones for free, confidential help. Typically, the earlier you contact us, the better the outcome.

An IVA stops creditor pressure and writes off debts you can’t afford. No more text messages, emails, letters, phone calls, or home visits from your creditors. The IVA team at Bennett Jones will work closely with you on your journey to financial recovery. An IVA can help you break free from the stigma of debt.

An Individual Voluntary Arrangement (IVA) is not suitable for everyone who needs help with their debts. If an IVA is not right for you we will give you free no-obligation help so you can decide on the solution you need.

An IVA can stop legal action and bailiffs, with the exception of unpaid court fines, student loans and child support. All other debts, such as parking tickets, council tax, and high court writs can be paid off using an IVA and Bennett Jones will contact your creditors to stop the action.

We will help you get out of debt, with your loans, credit cards, catalogues, payday loans and many other debts. Stop creditors harassing you. Check if you possibly qualify for an Individual Voluntary Arrangement in 60 seconds, by completing the form above. We can do a brief assessment and tell you what documents are required to move forward with your case. Once the final IVA payment is made, you are no longer liable for any of the debts included in your IVA and there will be no further balance to pay, even if this means your debts have not been repaid in full.

Links to find out more

The debt write off amount for each customer differs depending upon their individual financial circumstances and is subject to the approval of their creditors. The example provided of 80% has been achieved by 10% of our customers in the last 12 months. We understand how difficult it is to cope with unmanageable debts and the stress and worry this causes. Bennett Jones is here to help you explore all the options for you to regain control of your finances and become debt-free.

Listen

We will listen carefully to your individual story with empathy and understanding

Solve

We will provide you with all the help and assistance you need to solve your debt worries

Support

If an IVA is right for you, we will support you all the way on your journey to debt freedom

We will listen carefully to your individual story with empathy and understanding. We will provide you with all the help and assistance you need to solve your debt worries. If an IVA is right for you, we will support you all the way on your journey to debt freedom