What is an IVA? It is a formal agreement between you and your creditors. It is a fixed-term debt plan that legally protects you from your creditors.

If you are a homeowner, once your IVA is approved your home is protected. If you have a private pension this will also be protected. Typically an IVA will last for 5 years with you making an affordable monthly payment from your income into your IVA. Once your IVA has been fully approved, you don’t need to worry any more about your creditors contacting you. Once the final IVA payment is made, you are no longer be liable for any of the debts included in your IVA and there will be no further balance to pay, even if this means your debts have not been repaid in full.

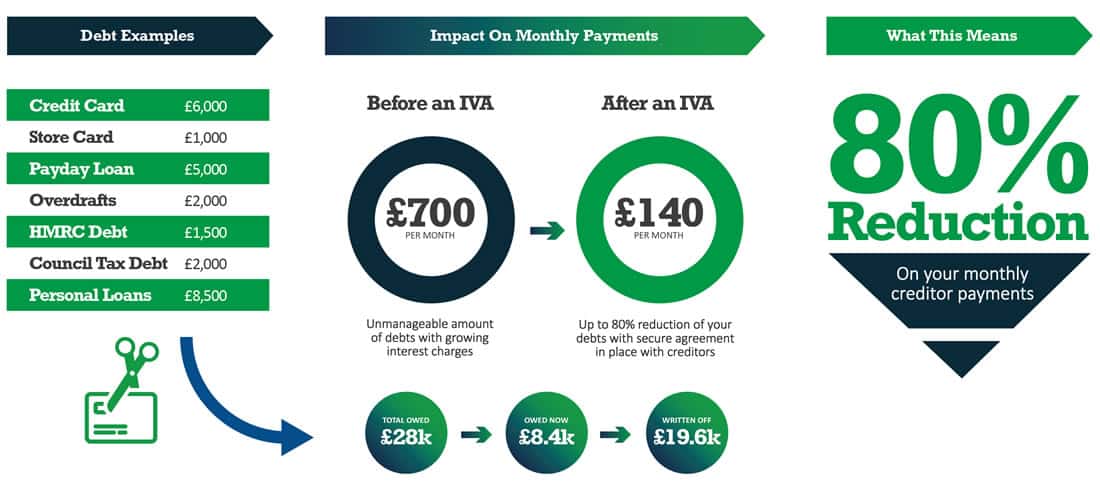

What an IVA could do for your finances

Insolvency practitioners are licensed to advise on and undertake work during all formal insolvency procedures. Your first point of contact with us is likely to be with a member of our IVA Proposals team. This team will discuss the various debt relief options available, and only once you are sure that an IVA is the right choice for you will we explain the proposal process. The team will then make sure we have all the financial information and documents we need to be able to prepare a proposal that can be presented to your creditors.

Greg Mullarkey is the Managing Director at Bennett Jones and is a licensed insolvency practitioner and non-practising solicitor. Greg has decades of experience in the financial and legal sectors, using his knowledge to assist people in complex monetary matters. Greg acts as a trusted Nominee and Supervisor for anyone entering debt solution schemes like individual voluntary arrangements (IVAs).

Greg Mullarkey is a long-standing member of the R3 Association of Business Recovery Professionals: a leading British association for business recovery specialists. R3 is renowned for promoting best practice professional standards for its members, playing an integral role in insolvency legislation by encouraging the promotion of a responsible, effective business rescue culture. Greg Mullarkey is also authorised and regulated by the Insolvency Practitioners Association (IPA) to act as a licensed Insolvency Practitioner in the UK. As the second-largest regulator of Insolvency Practitioners, the IPA aims to promote and maintain standards of performance and professional conduct amongst those engaged in insolvency practice. The organisation campaigns for a greater understanding of insolvency through examinations, qualifications and membership. The IPA also engage in regular debate and discussion surrounding insolvency issues that affect the profession, its stakeholders and the general public.

Whatever your question may be, we’ll connect you to the relevant person who’s equipped with the knowledge and credentials to help. You are not alone, millions of people suffer from debt problems. Bennett Jones has helped thousands of people solve their debt problems. Many get into financial difficulty and need debt help at some point in their life, often caused by one event such as divorce or unemployment. But many people reach to breaking point due to years of cumulative spending and debt interest building ever higher. We listen to every client’s story with empathy and understanding. We then offer debt help tailored to your personal circumstances.

Breathe easier with an IVA today

Our team at Bennett Jones has many years of experience in dealing with creditors and administering IVAs. We are here to provide support and guidance for you at a time when you need it most. If you believe an IVA may be the best solution or you would like to learn more about what the process entails, our experts can provide you with confidential advice completely free of charge. There are lots of ways to contact our IVA team:

- Complete the form above

- Call us on 0161 960 0054

Why Choose Bennett Jones for an IVA?

Bennett Jones has helped thousands of people solve their debt problems. Listening to every story with empathy and understanding, we offer debt help that is tailored to your personal circumstances.

An IVA stops creditor pressure and writes off debts you can’t afford. No more text messages, emails, letters, phone calls, or home visits from your creditors. The IVA team at Bennett Jones will work closely with you on your journey to financial recovery. An IVA can help you break free from the stigma of debt.

An Individual Voluntary Arrangement (IVA) is not suitable for everyone who needs help with their debts. If an IVA is not right for you we will give you free no obligation help so you can decide on the solution you need.

What is an IVA Practitioner?

An IVA is a legal agreement between you and your creditors. It is established and overseen by a Licensed Insolvency Practitioner, who acts as the mediator between you and your creditors. The exact amount of your monthly payment will depend on your circumstances but can start from as low as £70. If you are a homeowner, once your IVA is approved your home is protected. If you have a private pension this will also be protected.

It is realistic to expect to write off between 25% and 75% of your debts in an IVA. The debt write off amount will depend on your circumstances and is subject to your creditors approving your proposal. Your monthly IVA payments may be different to the example as they will be based on your personal circumstances. All fees and costs of your IVA which will be paid from your monthly IVA payments will be clearly explained to you.

Typically an IVA will last for 5 years with you making an affordable monthly payment from your income into your IVA. Once your IVA has been approved, you don’t need to worry any more about your creditors contacting you.

Your insolvency practitioner who supervises your IVA will deal with all your creditors. Once the final IVA payment is made, you are no longer liable for any of the debts included in your IVA and there will be no further balance to pay, even if this means your debts have not been repaid in full.

To be eligible for an IVA, you need to show that you do not have enough money to pay your debts in a reasonable amount of time. In most cases, your debts must be more than your assets, including any property you own. You also need to have some surplus income each month after paying for your living costs. When you talk to Bennett Jones about an IVA or other debt solutions, we make sure that you are aware of all the possible solutions for your situation. You will be able to make the best choice for your circumstances. If you decide an IVA is right for you, we will support you on your journey to financial health.

We understand how difficult it is to cope with unmanageable debts and the stress and worry this causes. Bennett Jones is here to help you explore all the options for you to regain control of your finances and become debt-free.

IVA steps and timing

To qualify for an IVA, you need to be a resident of England, Wales or Northern Ireland. You will also need to have a minimum debt level of £6,000. You must owe money to at least 2 companies. You will need to have some surplus income after paying your living expenses so that you can afford to make payments into your IVA.

All IVAs must be arranged through a licenced insolvency practitioner and that is where Bennett Jones steps in. If you qualify for an IVA, you could be on your way to writing off your seemingly unaffordable debts, setting you up for a debt-free future.

IVA is short for Individual Voluntary Arrangement and DMP is short for Debt Management Plan. IVAs allow you to write off a large proportion of your debt and they are legally binding on your creditors. A DMP is not legally binding – it is simply an informal agreement between you and some or all of your creditors. This means that if you are in a DMP your creditors can still take legal action against you and continue to contact you directly.

In England and Wales, an Individual Voluntary Arrangement (IVA) is a formal alternative for individuals wishing to avoid bankruptcy. In Scotland, the equivalent debt solution is known as a Protected Trust Deed.

Once an IVA is agreed upon, creditors are forbidden from contacting you directly to attempt to obtain funds. Whilst they usually receive a larger payment than they would with bankruptcy, you benefit from frozen interest/fees and manageable payment structures. What is more, with an IVA, you only pay what you can afford, even if this means you do not pay your debts in full.