Thank you,

- The Debt Advisor will call you soon.

- From the information you gave us, it looks like we can help, so please keep your phone nearby.

- If you can't speak now, then reply to our introductory text message, or send us a WhatsApp message

- Please read our 5* Trustpilot reviews below.

- You will be able to speak in confidence to one of our debt specialists at The Debt Advisor, who will find out what you owe to your creditors, and what you can afford to pay.

What happens next?

- Take a moment to relax, we will be calling you soon.

- During the brief call, we’ll gather some information regarding your current situation to help us understand how we can help.

- We are qualified to talk to you about a wide range of potential solutions. You are under no obligation to proceed, and you are welcome to ask as many questions as you'd like.

- If talking over the phone is difficult, we can chat over WhatsApp.

- After talking with us, if you feel one of the debt solutions we provide will help you to become debt free in the near future, we will email you an application pack and will help guide you through the process from there.

You’re not alone, we've helped thousands get out of debt

If you've read this far, then it looks like you are as serious as we are to get you debt free. The team at Bennett Jones and The Debt Advisor will help you every step of the way. Sometimes debt leaves people feeling too embarrassed to talk or pick up the phone, so we want to put you at ease. When our advisor calls, you’ll soon see that we are on your side. We will listen to you and get you on the path to financial recovery.

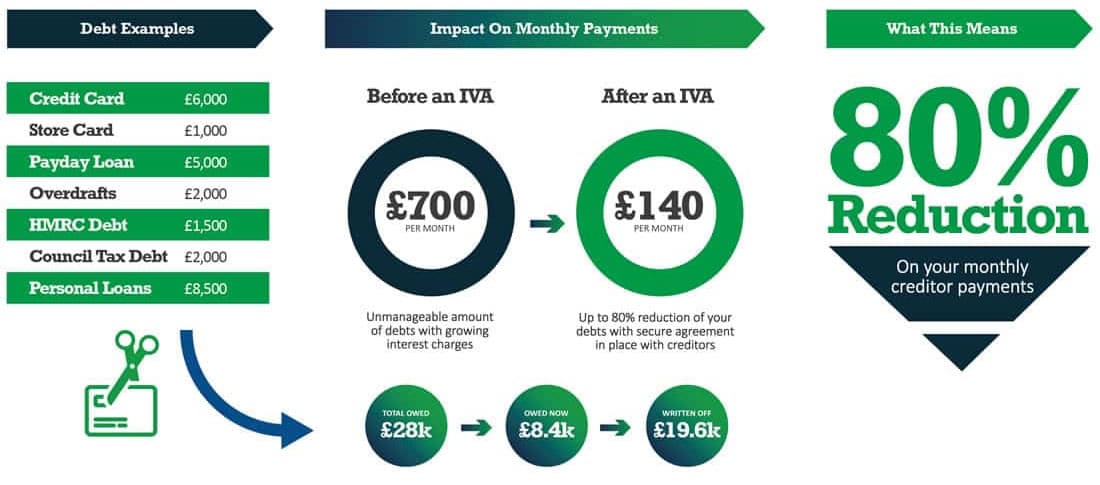

What an IVA could do for your finances

Here are just some of our recent 5* trustpilot reviews:-

Jonathan, April 2023

Supported to get debt free

"The Bennett Jones team have been great at discussing my choices and helping me arrange an IVA. The support has been invaluable. I can now relax knowing my finances are being taken care of. I discussed an IVA last month and it’s been agreed today following my creditors meeting"

Tina, April 2023

Very helpful and non judgemental

"Very helpful and non judgemental, whatever your circumstances are, if you are struggling to afford your debts and suffering from stress and anxiety this causes, Jones Bennett can help you, they deal with your creditors direct on your behalf and keep you fully informed all the way through the process. There is light at the end of the tunnel, don't be ashamed to ask for help it can change your life."

Danielle, April 2023

I kept putting off sorting my finances

"I finally picked up the courage to talk to someone about this as I’d felt embarrassed about where I was.

They were fantastic from the first call, and I didn’t realise how much they could help. My IVA has been approved today and it’s the start of my journey to becoming debt free. Cannot thank them enough."