Bennett Jones has many years of experience helping people build stronger finances. We will help you with loans, credit cards, catalogues, payday loans and many other debts.

Check if you qualify for debt help by completing the form above. We can do an assessment and then explain the next steps. Our team has the knowledge, experience and professional qualifications to ensure you receive the right guidance.

Bennett Jones - the debt help & IVA specialists

Breathe easier with our debt help today

Our team at Bennett Jones has many years of experience in dealing with creditors and helping clients deal with debt. We are here to provide support and guidance for you at a time when you need it most. If you would like to learn more about an IVA , our trusted partner will provide you with confidential help. There are lots of ways to contact our team:

- Complete the form above

- Call us during office hours on 0161 960 0054

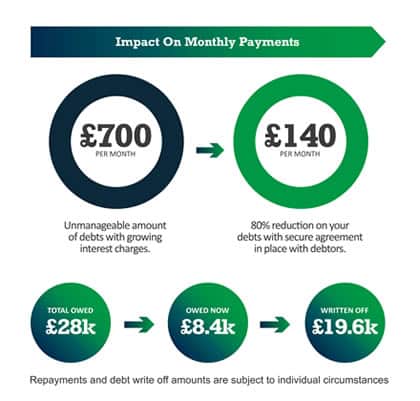

Bennett Jones has helped thousands of people solve their debt problems. If you are eligible we can help stop creditor pressure and help you write off debts you cannot afford. The team at Bennett Jones will lead you towards financial recovery, breaking you free from the stigma of debt.

Our simple 3 step process:-

Step 1

Complete our online form (completely private & confidential).

Step 2

Chat to an advisor from The Debt Advisor Ltd. We know how difficult it is to have unmanageable debts, but trained debt specialists are here to help without judgement.

Step 3

Our team will help you get a solution in place. Dealing with your debts will help you stay on budget and pay an affordable monthly contribution.

Check if you qualify by completing the form above and we can contact you to go through an assessment.

Read more below about the solutions to problem debt

Bennett Jones is here to help you explore all the options for you to regain control of your finances and ultimately become debt-free. Our team members have the knowledge, experience and professional qualifications to ensure you receive the guidance and support you need to navigate your journey to financial recovery. We comply with all statutory, regulatory and best practice obligations.